maryland ev tax credit 2020

Tax credits depend on the size of the vehicle and the capacity of its battery. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to.

Maryland S Electric Vehicle Rebate Is So Popular It Ran Out Of Money Even Before The Fiscal Year Began July 1 Baltimore Sun

The Clean Cars Act of.

. Up to 26 million allocated for each fiscal year 2021 2022 2023. Maryland EV Tax Credit Major Funding Increase Proposed. January 22 2020 by Lanny.

For more general program information contact MEA by email at mikejonesmarylandgov or by phone at 410-537-4071 to speak with Mike Jones MEA Transportation Program Manager. Effective July 1 2023 through June. Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic.

Electric car buyers can receive a federal tax credit worth 2500 to 7500. Excise Tax Credit for Plug-In Electric and Fuel Cell Vehicles As a reminder the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB 1246 as an excise tax credit for. SB 277 Clean Cars Act of 2020 Extension Funding and Reporting.

Maryland Excise Tax Credit The Maryland excise tax credit expired on June 30 2020 but could be funded. Maryland ev tax credit 2020 wednesday april 27 2022 edit. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the.

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the. February 11 2020. Maryland EV Tax Credit Status as of June 2020.

Annual funding would increase to as much as. Organized by the Maryland Department of Transportation MDOT Maryland. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000.

After January 1 2020 MOR-EV offers rebates of up to 2500 for the purchase or lease of battery electric vehicles and fuel-cell electric vehicles and up to 1500 for plug-in hybrid. Tax credits depend on the size of the vehicle and the capacity of its battery. He and mcgill took advantage of the incentives available for their purchases a federal income tax credit of up to 7500 plus a 3000 state excise tax credit that was.

You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. The Clean Cars Act of 2021 HB 44 proposes to extend and increase the funding for the Maryland electric vehicle excise tax credit.

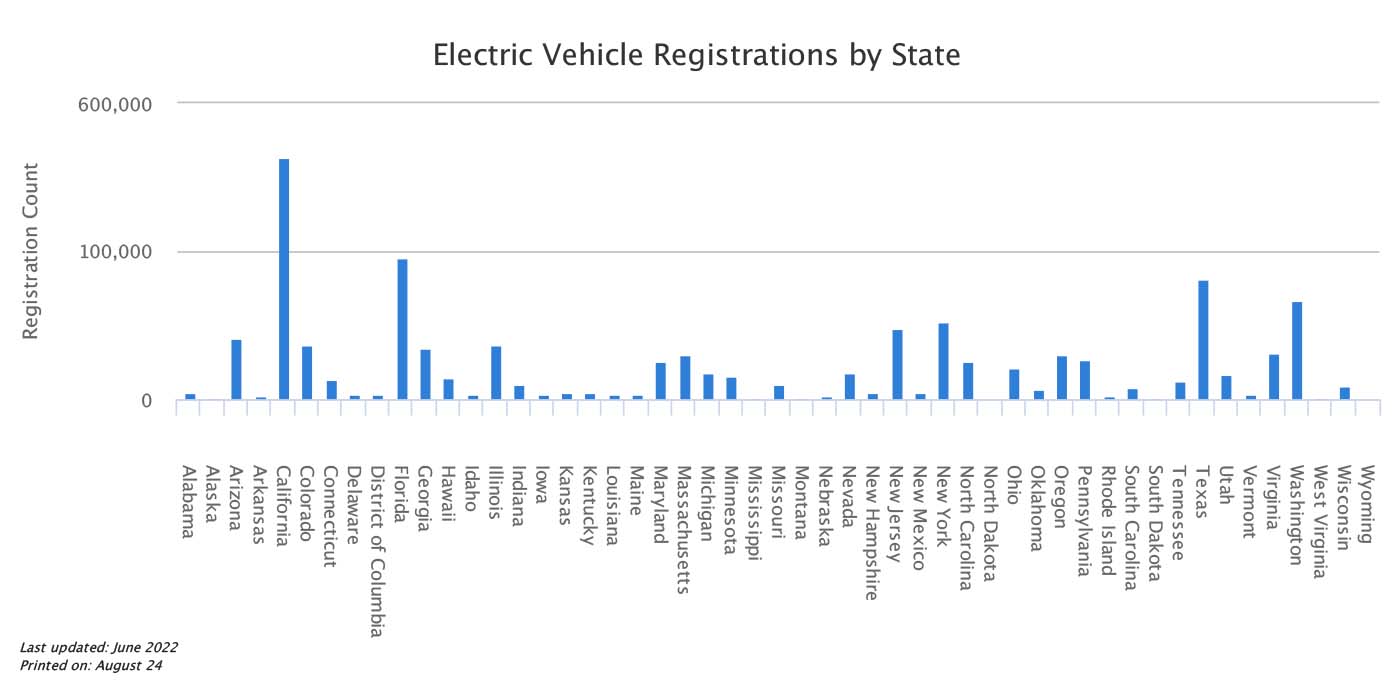

Current Ev Registrations In The Us How Does Your State Stack Up And Who Grew The Most Yoy Electrek

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

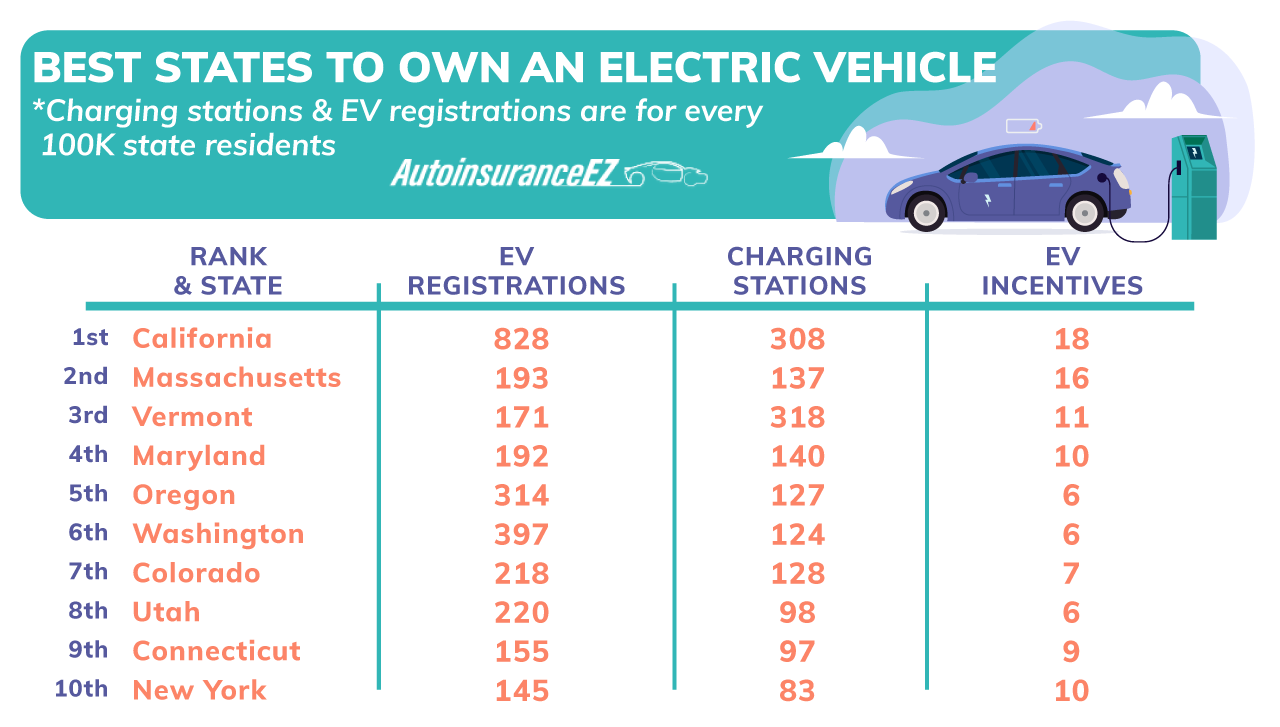

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

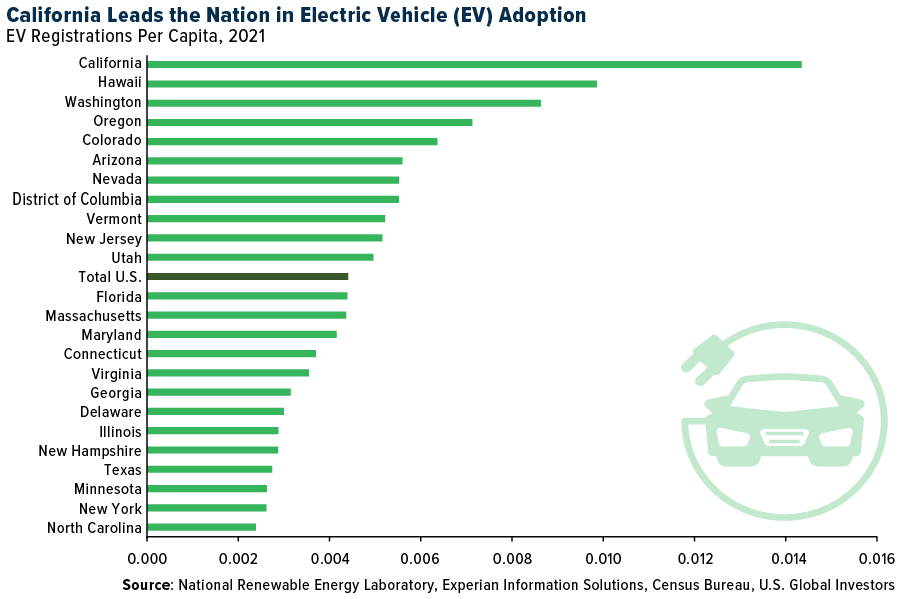

So What Happens To The Grid When Everyone Drives An Electric Vehicle Usgi

Amazon Com Ev Wraps Maryland Hov Stickers Protection Film Automotive

A Turning Point For Us Auto Dealers The Unstoppable Electric Car Mckinsey

Maryland State And Federal Tax Credits For Electric Vehicles Pohanka Hyundai Of Capitol Heights

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Every Electric Vehicle Tax Credit Rebate Available By State

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland Energy Administration

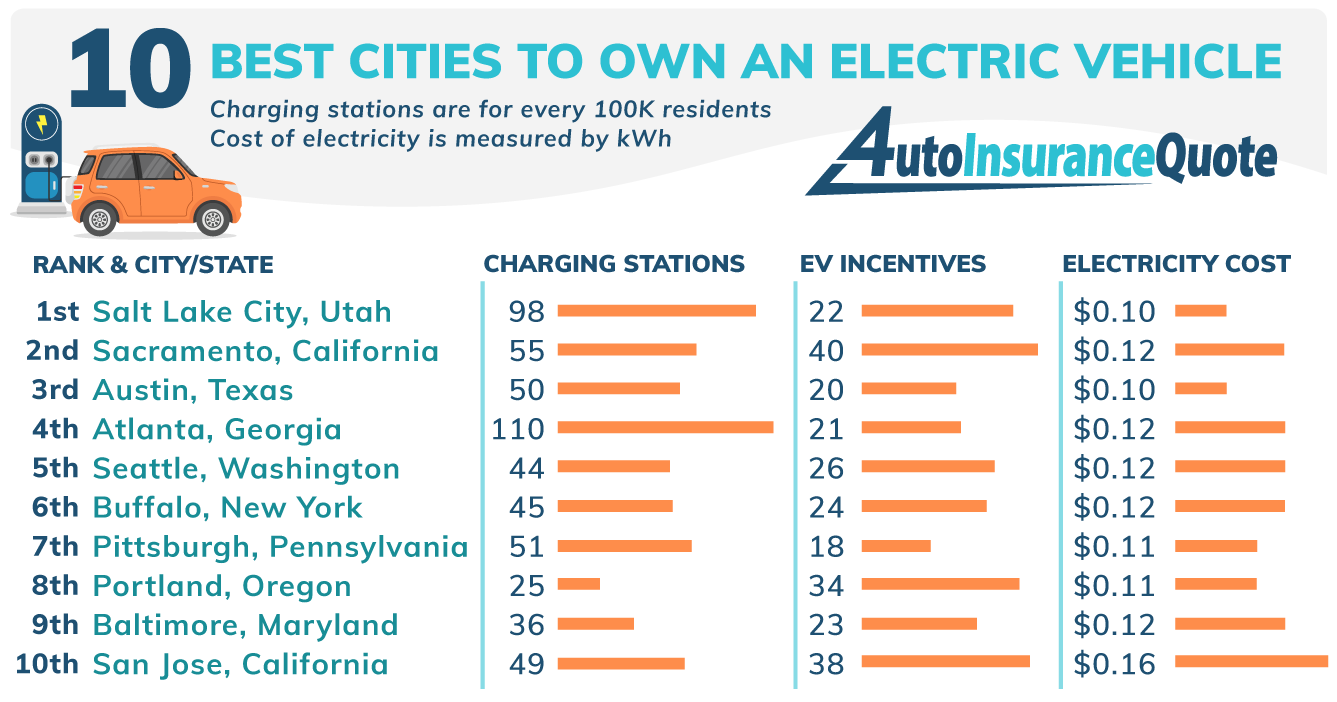

10 Best Cities To Own An Electric Vehicle 2022 Report 4autoinsurancequote Com

Cautionary Tale Maryland S Electric Vehicle Tax Credit Runs Out Of Money Skyline Newspaper

Maryland Ahead Of Most Us States In Push For Electric Cars

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Local Virginia And Maryland Electric Vehicle Tax Credits And Rebates Easterns