kentucky sales tax on vehicles

Loyd Bailey Roese and Stephanie M. Remote sellers are required to collect Kentucky sales tax if they.

Kentucky S Car Tax How Fair Is It Whas11 Com

How to Calculate Kentucky Sales Tax on a Car.

. Be subject to the sales or use tax. Motor Vehicle Usage Tax. USA November 1 2022.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Of course you can also use this handy sales tax calculator to confirm your. KRS 138477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents 003 per kilowatt.

The state of Kentucky has a flat sales tax of 6 on car sales. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006. Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple.

The state of Kentucky has a flat sales tax of 6 on car sales. LoginAsk is here to help you access Kentucky Vehicle Registration Tax quickly and. The state of Kentucky has a flat sales tax of 6 on car sales.

Kentucky Vehicle Registration Tax will sometimes glitch and take you a long time to try different solutions. Credit for Sales Tax Paid Out of State S8 - attach a copy of the receipt from the seller. Six percent Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky.

Dentons Bingham Greenebaum LLP - Mark A. To ensure the tax collected from the sale of motor vehicles to residents of states which do not allow Kentucky residents to purchase motor vehicles without paying that states. Military Exemption Kentucky Revised Statute.

For vehicles that are being rented or leased see see taxation of leases and rentals. KRS139470 is amended to read as follows. To the Motor Vehicle Use Tax.

In the state of Kentucky legally sales tax is required to be collected from tangible physical products being sold to a consumer. 16 2022 To help Kentuckians combat rising prices due to inflation brought on by the global. For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals.

Kentucky has a 6 statewide sales tax rate but also. Does military pay sales tax on cars in kentucky Monday June 13 2022 Edit. In addition to taxes car.

Remote sellers are required to. On used vehicles the usage tax is 6 of the current. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

Sales Tax 45000 - 2000 06 Sales. HB 487 effective July 1 2018 requires remote. Several exceptions to this tax are most types of farming.

Kentucky has a 6 statewide sales tax rate. The vehicle sales tax in Kentucky is 6 on all car sales and there are no additional sales taxes by city or county. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky.

Aviation Fuel Dealers 51A131. It is levied at six percent and shall be paid on every motor vehicle. Total compensation may not exceed 50.

Kentucky does not charge any additional local or use tax. Equine Breeders 51A132 Remote Retailers. 2 Motor vehicles which are not subject to the motor vehicle usage tax established in KRS 138460 or the U-Drive-It tax established in KRS 138463 shall be.

Property Valuation Administrators PVAs in each. What is Kentucky sales tax on vehicles. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180.

Photos of this event can be found here. Sales Tax Paid to a Kentucky Vendor S9 - attach a copy of the receipt from the seller. Start filing your tax return now.

If you cant read this PDF you can view its text here. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Kentucky Ford Dealer Ford Cars Trucks Suvs In Stock

Kentucky Vehicle Registration Laws Com

Used Cars In Kentucky For Sale Enterprise Car Sales

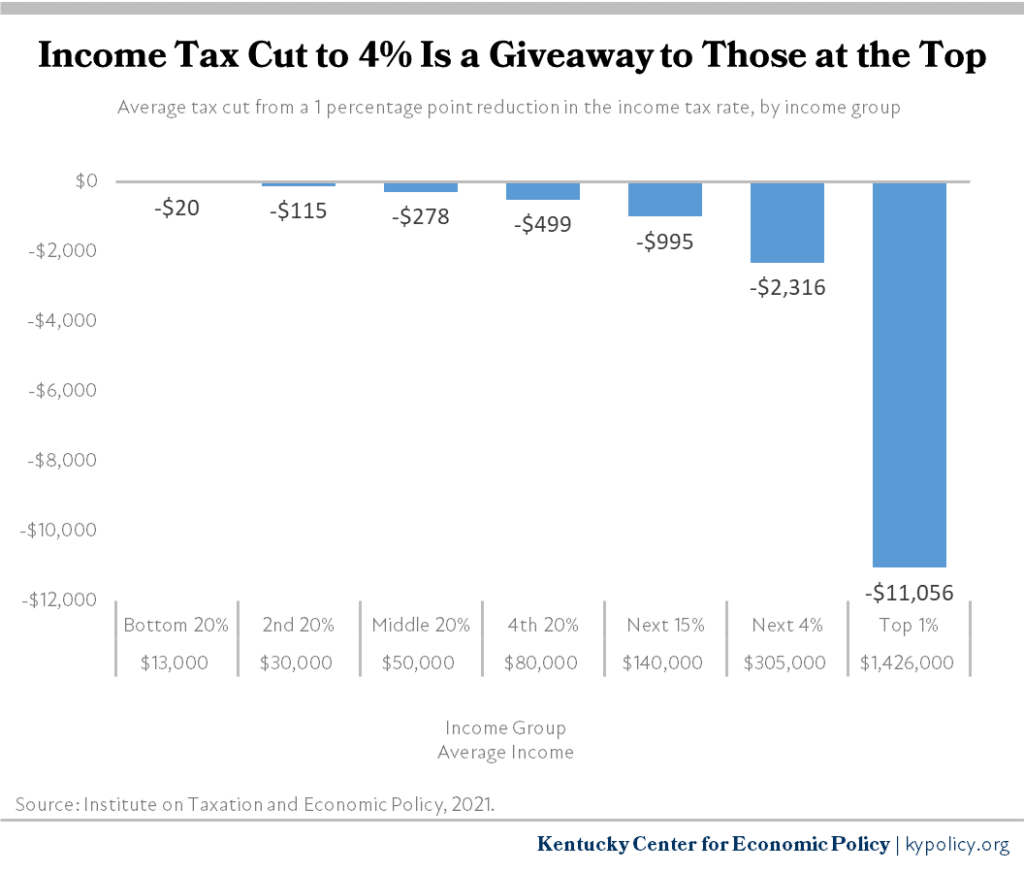

House Tax Bill Would Devastate Kentucky S Budget For A Giveaway To The Wealthy Kentucky Center For Economic Policy

Lawmakers Propose Bills To Ease Vehicle Tax Burden

Kentucky S Car Tax How Fair Is It Whas11 Com

Kentucky Lawmakers File Bills To Combat Rising Car Tax Whas11 Com

Taxes Fees Greenup County Clerk

Used Cars Of Kentucky For Sale With Photos Cargurus

2022 Kentucky Income Tax Reform Details Analysis

Kentucky State Tax Guide Kiplinger

What To Do After A Hit And Run In Kentucky Bankrate

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Motor Vehicle Taxes Department Of Revenue

What S The Car Sales Tax In Each State Find The Best Car Price

How To File And Pay Sales Tax In Kentucky Taxvalet

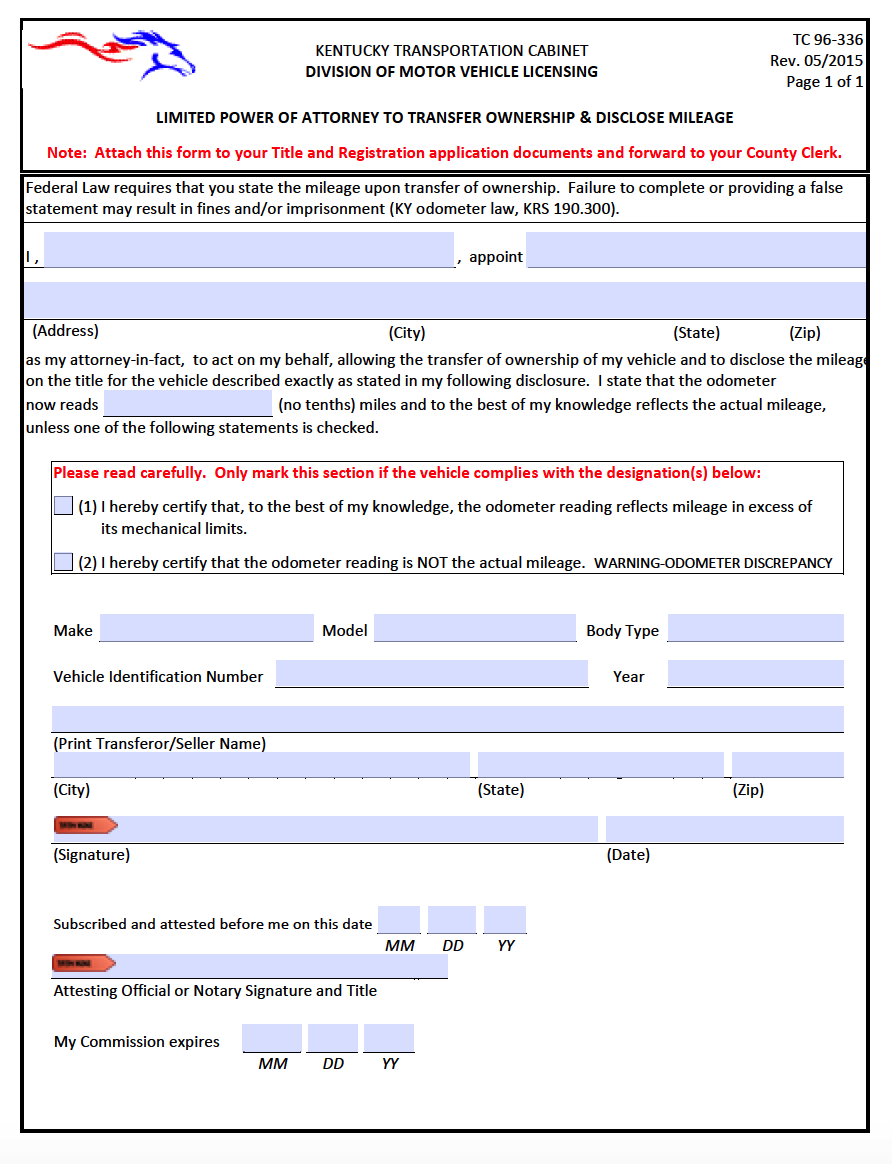

Free Motor Vehicle Power Of Attorney Kentucky Form Tc 96 336

The Best Selling Vehicles In Louisville And Kentucky Louisville Business First